Managing multiple concepts? Here’s how to simplify your financial consolidation process.

If you operate multiple restaurant concepts, you already know: the challenge isn’t just running a great business. It’s running several, each with its own P&L, operational quirks, and financial data. One might be a fast-casual burger joint, another a polished taqueria, and another a family-friendly pizza brand. All with different menus, team sizes, and peak hours.

But at the end of the day, there’s one common denominator: they all roll up to your bottom line. That’s why having a streamlined process for financial consolidation for multi-unit restaurants is critical if you want clarity and control over your numbers.

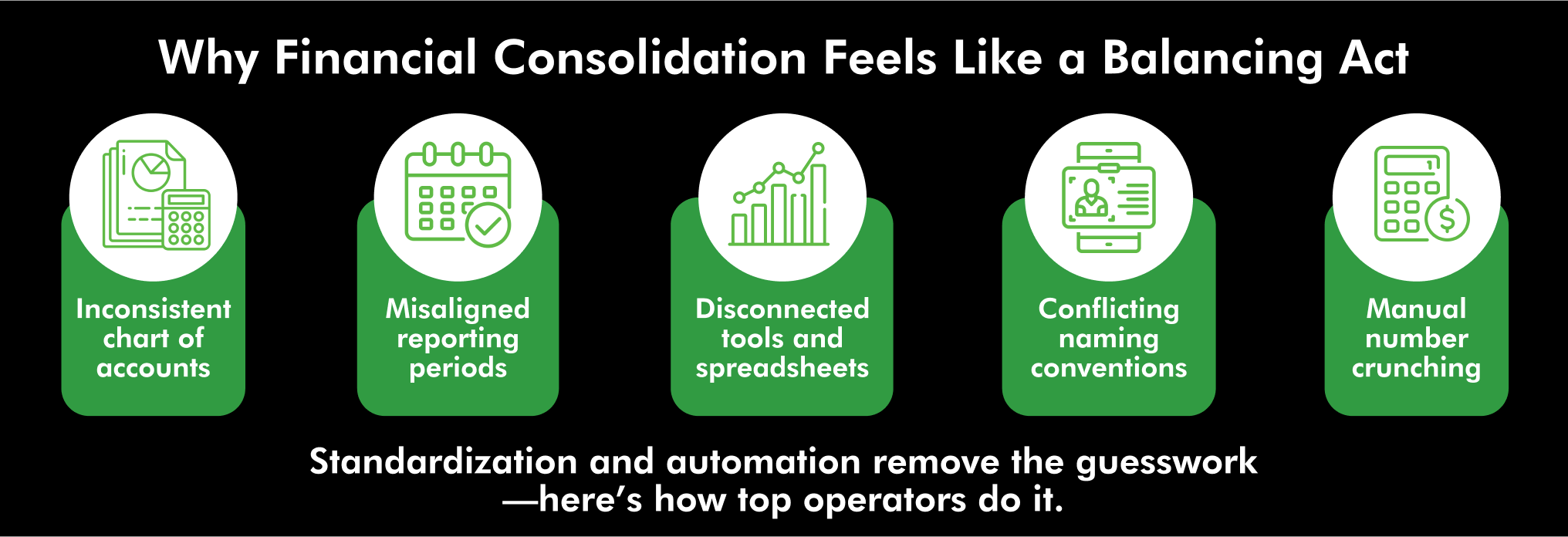

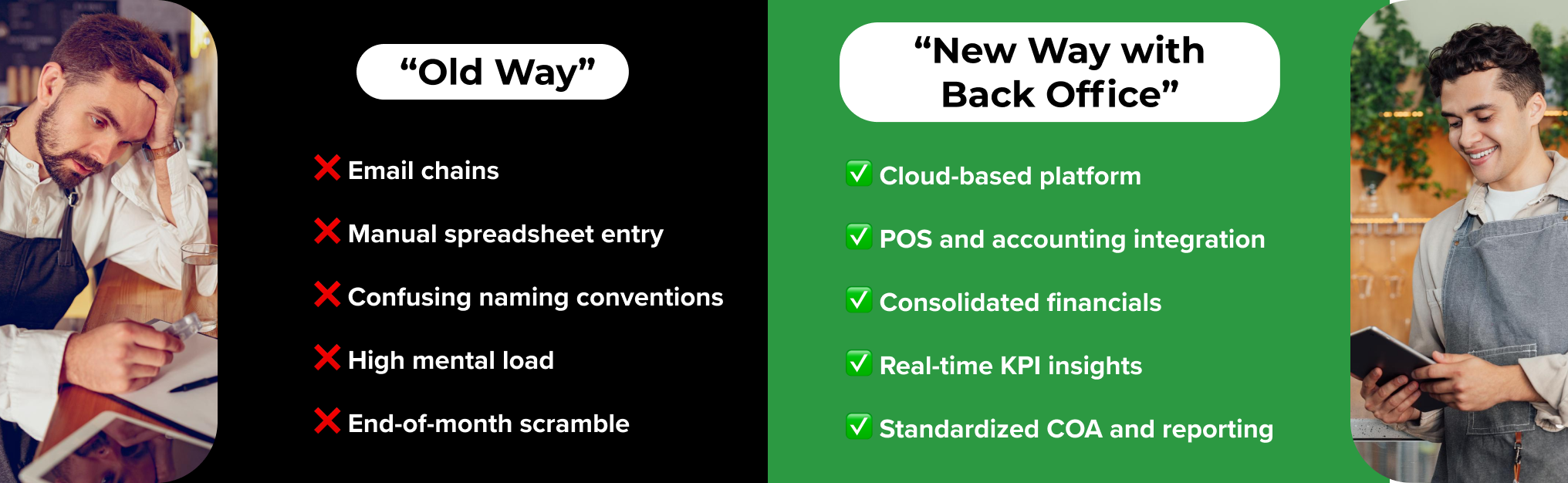

For growth-minded operators, getting a clear picture of that bottom line is easier said than done, especially if your financial consolidation process still includes spreadsheets, email chains, and last-minute manual work. If your back office feels more like a balancing act than a business engine, you’re not alone.

Let’s walk through how top-performing operators consolidate and evaluate financial performance across multiple brands and how you can, too.

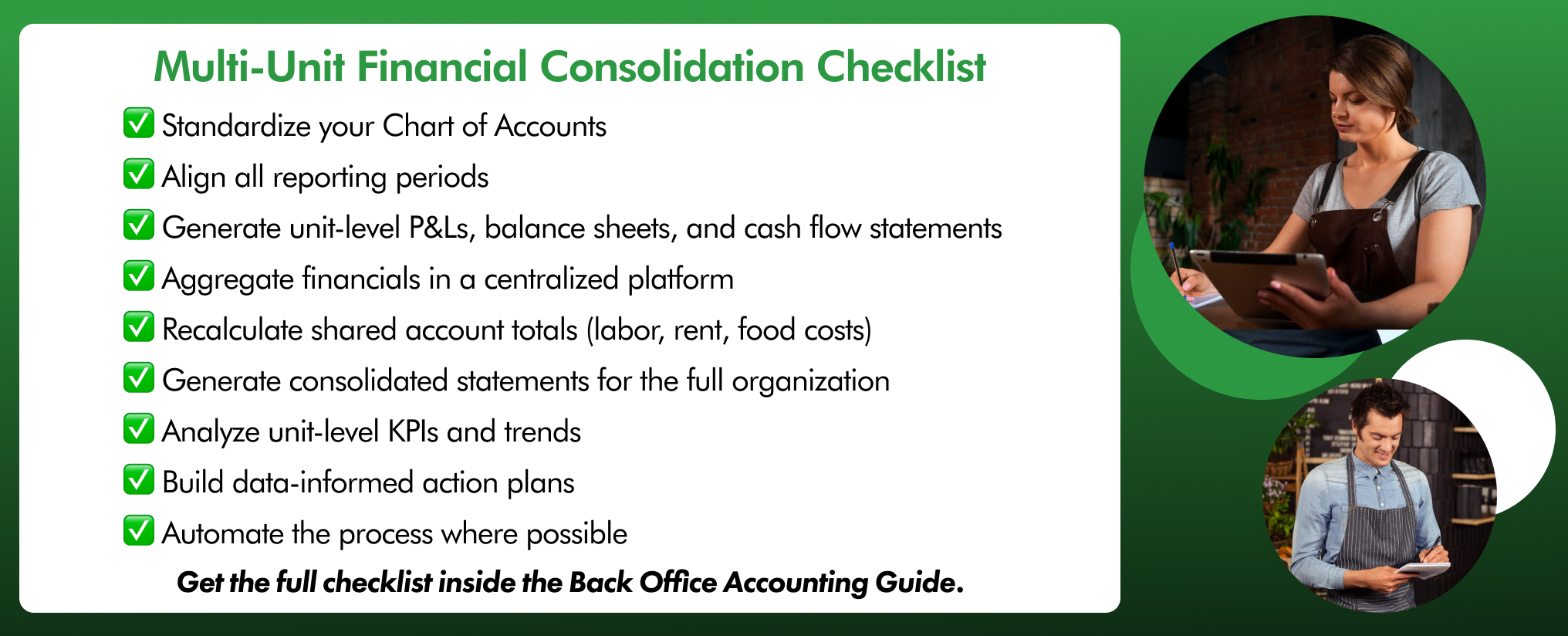

First, Standardize Your Chart of Accounts

Before you can analyze anything, you have to speak the same financial language across all units. That starts with your Chart of Accounts (COA).

It’s essential that your COA includes every category used across every brand or location, from food costs to linen services to third-party delivery fees. If one brand tracks beverage purchases under “Beverage Supplies” and another calls it “Bar Inventory,” you’ll spend hours just trying to match terms before you ever see the numbers.

Pro Tip: Use a cloud-based centralized system that references the same COA across all locations. That way, every entry feeds into one standardized structure.

Align Your Reporting Periods

There’s nothing more frustrating than trying to compare financials from different units—only to realize one location is on a four-week period while another tracks by calendar month.

Establishing a unified reporting schedule across all brands helps eliminate that misalignment. Communicate this schedule clearly with location managers and ensure they understand the deadlines and the importance of consistency.

This one move can reduce the friction of your month-end or period-end wrap-ups significantly.

Generate Financial Statements at the Unit Level

Next, it’s time to dig into each brand or location’s individual performance. This means pulling:

- Profit & Loss Statements

- Balance Sheets

- Cash Flow Statements

Each location should have these reports generated individually before any consolidation happens. Accuracy at the unit level is critical—if the individual statements are flawed, your consolidated financials will be, too.

This is also a key opportunity to spot early indicators of performance trends—positive or negative—before you’re looking at rolled-up numbers.

Bring It All Together

Once your unit-level statements are clean, it’s time to consolidate.

That doesn’t just mean copy-pasting line items into a mega spreadsheet. You’ll want to:

- Recalculate combined totals for shared accounts like labor, food cost, or rent

- Cross-reference brand-specific costs with systemwide ones

- Ensure all totals still balance and reflect actual operational activity

With multiple locations, this part can feel like a full-time job—especially if you’re managing it with spreadsheets or disconnected software.

Generate a Consolidated Financial Statement

Once your data is aggregated, use it to generate a true consolidated set of financials that reflects your organization as a whole. This is what allows you to speak to investors, make informed growth decisions, and forecast more accurately.

Make sure the new, combined financials are:

- Balanced

- Accurate

- Reflective of operational realities

- Aligned with your strategic goals

This is your chance to step back and assess your entire business, not just each store.

Evaluate Unit-Level Performance

Now that your financials are in order, it’s time to get analytical. Dig into unit-specific reports and track the KPIs that really matter:

- Cost of Goods Sold

- Labor Cost Percentage

- Average Check Size

- Table Turnover Rate

- Food Cost %

- Inventory Turnover Rate

Each metric tells a story. Maybe one location is crushing sales but struggling with labor efficiency. Maybe another has strong food cost control but underperforms in average check size. When you know the story, you can write a better strategy.

Identify What’s Working and What’s Not

You’re now in a position to compare unit performance with intention. Look at:

- Best-selling and worst-selling items

- Promotional campaign effectiveness

- Overtime trends and labor inefficiencies

- Waste patterns or signs of theft

- Units that consistently over- or under-perform

The goal? Build action plans for underperformers—and replicate winning tactics from your high-performers.

One More Thing: Automate It

Let’s be honest: even the best checklist still takes time. And if you’re scaling, that time adds up fast. Modern platforms designed for financial consolidation for multi-unit restaurants can eliminate hours of manual work and replace them with just a few clicks.

That’s why more multi-unit operators are investing in platforms like Back Office, which automates financial consolidation across all locations. It turns hours of reconciliation into just a few clicks, so you can spend less time crunching numbers and more time optimizing operations.

The Bottom Line

When you’re leading multiple restaurant concepts, you need more than intuition—you need visibility. Financial consolidation isn’t just about getting the numbers to add up. It’s about unlocking insights that help you scale smarter, faster, and with less friction.

And if you’re looking for a streamlined way to build your consolidation process, complete with practical steps, real-world strategies, and tools that make the job easier, there’s a resource built specifically for multi-unit operators like you.

Click here to take the complexity out of consolidation and get back to growing your business.

Consistency, clarity, control—it all starts with how you manage your financials.

Click here to learn more about how Consolidated Concepts helps multi-unit restaurants streamline financial consolidation and boost profitability.