How to Develop An Exciting Menu Without Sacrificing Margins

Menu development isn’t just about adding new dishes—it’s about creating smart, profitable offerings that resonate with your guests and strengthen your brand.

Menu innovation is no longer optional—it’s essential. Diners are constantly looking for new flavors, unique experiences, and better value. Whether it’s the rise of plant-based eating, globally inspired dishes, or elevated comfort foods, consumer preferences are shifting fast. Staying relevant means keeping up—but not at the expense of your bottom line.

For multi-unit restaurant operators, the challenge isn’t if you should evolve your menu—it’s how to do it profitably.

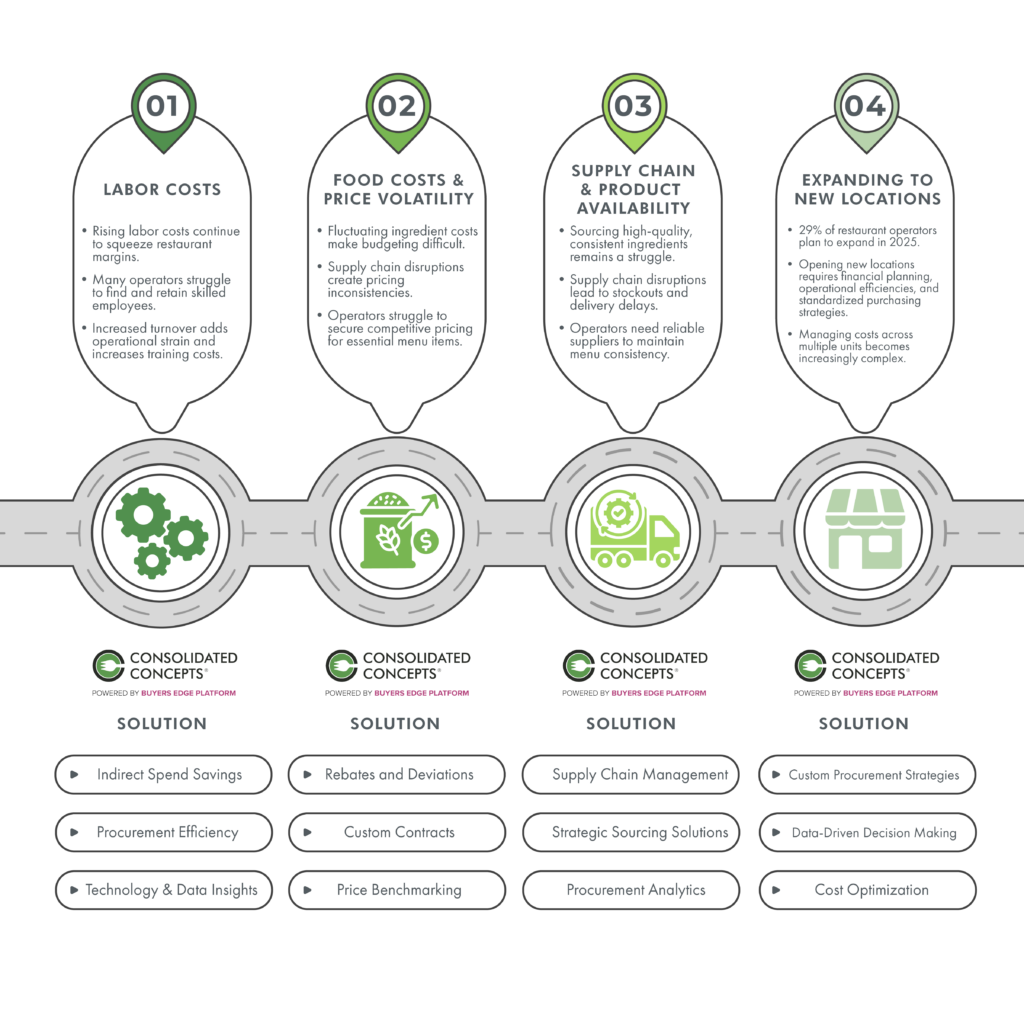

The stakes are high:

- Rising ingredient costs squeeze margins.

- Labor challenges limit operational capacity.

- Supply chain volatility disrupts consistency.

- Competitive pressure demands constant differentiation.

So how do you create exciting new menu items and protect your margins?

That’s where Consolidated Concepts comes in.

At Consolidated Concepts, we help you walk that fine line between creativity and cost control. Through data-driven insights, strategic supplier partnerships, and smart technology solutions, we give you the tools to innovate confidently—without compromising profitability.

From ideation to execution, we help you turn bold menu development ideas into scalable, margin-friendly reality.

Menu Development That Makes Business Sense

- Understand What Your Guests Really Want: Trends come and go, but data-backed insights last. We analyze customer preferences to help you introduce items that resonate—whether it’s plant-based alternatives, global flavors, or twists on classic favorites. It’s not about adding trendy dishes for the sake of it—it’s about strategic innovation that drives traffic and loyalty.

- Engineer Menus for Profitability: New menu items shouldn’t come at the expense of your margins. We work with your team to optimize portion sizes, streamline ingredient usage, and set strategic pricing that protects profitability. Our menu engineering expertise ensures every dish is designed to deliver both guest satisfaction and financial performance.

Technology That Simplifies Menu Development

- Real-Time Recipe Costing: No more guessing games. With recipe costing tools, you gain visibility into actual dish costs, empowering smarter decisions on menu adjustments, pricing strategies, and ingredient sourcing—all in real time.

- Inventory and Ordering Optimization: Managing inventory across multiple locations can drain resources. Our technology solutions automate ordering and streamline inventory management, reducing waste, controlling spend, and ensuring consistency across your entire operation.

Operational Support That Drives Growth

- Stronger Supplier Partnerships: Expanding your menu shouldn’t mean inflating your costs. We connect you with supplier partners that offer competitive pricing on high-quality ingredients. Through our network, you’ll tap into exclusive deals that protect your bottom line while enhancing your offerings.

- Tailored Solutions, Scalable Success: Every restaurant concept is different. That’s why we don’t offer one-size-fits-all solutions. From menu development to supply chain optimization, we collaborate with you to create strategies that fit your brand’s unique needs and growth goals.

Let’s Bring Your Menu Ideas to Life—Profitably

When done right, menu innovation fuels customer excitement and business growth. Consolidated Concepts gives you the insights, tools, and partnerships to make it happen—without sacrificing your margins.

Ready to innovate smarter? Fill out the form below or click here to contact Consolidated Concepts to see how we help multi-unit operators scale success with fresh, profitable ideas.